Starting a Fund

Establishing your own charitable fund is easy. You can choose to support your favorite nonprofit organization or let us help you identify the community’s most pressing needs. Gifts can be distributed during your lifetime, as a legacy, or both.

LET’S GROW TOGETHER

INTO 2025 AS WE CELEBRATE 30 YEARS – NEW NON ENDOWED FUNDS

MATCHING GRANT TERMS AND CONDITIONS – NEW NON-ENDOWED FUNDS

Overview:

The Delaware County Foundation is pleased to offer a Matching Grant program for qualifying contributions made to establish new non-endowed funds. In addition, donors who contribute $5,000 or more in stock

will have the stock processing fees waived.

This initiative is designed to encourage donors to increase their impact in celebration of the Foundation’s 30th anniversary.

Eligibility:

The program is for new Delaware County Foundation funds established before 09/15/2024. To qualify for a matching grant, a single contribution at one of the levels below must be received by November 15, 2024.

- Gifts of $5,000 or more will receive a $250 matching grant.

- Gifts of $25,000 or more will receive an additional $250 matching grant, totaling $500.

- Gifts of $100,000 or more will receive an additional $500 matching grant, totaling $1,000.

Matching Grant Details:

Matching grants are limited to one per fund, subject to availability, and will be awarded on a first-come, first-served basis.

Stock Contribution Details:

Donors contributing $5,000 or more in stock to their fund will have stock processing fees waived. This waiver represents a minimum value of $200.

Fund Availability:

Matching funds are limited and may be exhausted before the end of the promotion period. Donors are encouraged to make their contributions as early as possible to take advantage of the matching grant opportunity. Matching grants and fee waivers are non-transferable and cannot be exchanged for cash or other benefits. By participating in this promotion, donors agree to the above terms and conditions.

For any questions or further clarification, please contact the Delaware County Foundation

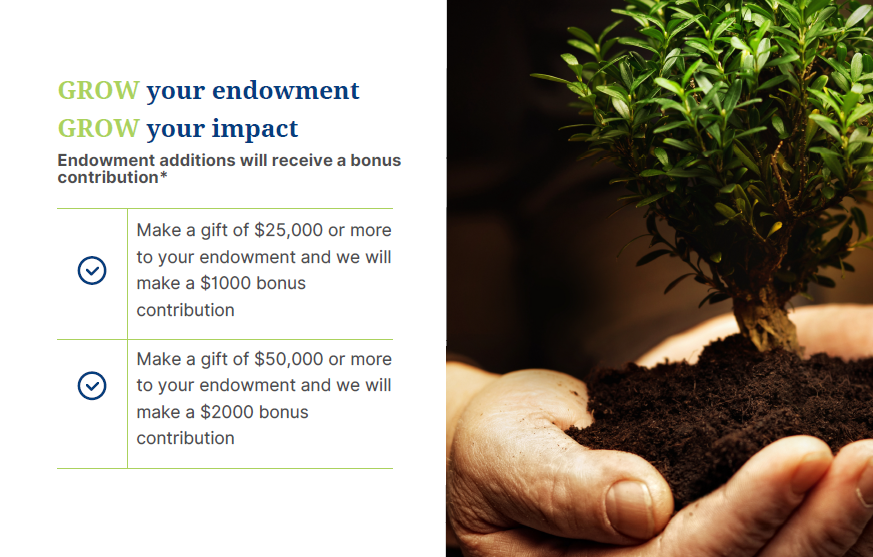

GRANT TERMS AND CONDITIONS – ENDOWED FUNDS

The Delaware County Foundation is pleased to offer a Matching Grant Program in celebration of our 30th year. This program is designed to encourage generous contributions to new or existing endowed funds by providing up to$2,000 in matching grants for qualifying donations.

Eligibility:

The program is open to all current Delaware County Foundation endowed funds. To qualify for a matching grant, a single contribution at one of the levels below must be received by November 15, 2024.

• A contribution of $25,000 or more will receive a $1,000 matching grant.

• A contribution of $50,000 or more will receive an additional $1,000 matching grant, totaling$2,000.

• All contributions must be received by November 15, 2024.

Matching Grant Details:

Matching grants are limited to one per fund, subject to availability, and will be awarded on a first-come, first-served basis. The matching grant will be applied to the endowment corpus and not to the fund’s spendable balance.

Fund Availability:

Matching funds are limited and may be exhausted before the end of the promotion period. Donors are encouraged tomake their contributions as early as possible to take advantage of the matching grant opportunity. Matching grantsand fee waivers are non-transferable and cannot be exchanged for cash or other benefits. By participating in thispromotion, donors agree to the above terms and conditions.For any questions or further clarification, please contact the Delaware County Foundation

Ways To Give

Making a gift can be a deeply personal and inherently rewarding experience, especially when you know that your generosity is having the impact that you desire.

Providing you with choices, while ensuring your gift represents your values and interests, is very important to us. Your contribution of any size can be directed to one of the Foundation’s initiatives or used to establish a fund focused on things that matter to you most.

TIME FRAME FOR MAKING YOUR GIFT

Gifts to the Foundation may be made outright in a single transaction, pledged over a period of time, or planned as part of your estate provisions.

ESTABLISHING A FUND

There are two types of funds that can be established with your gift. The most appropriate fund depends upon your philanthropic goals.

- Current Use Funds, which are fully expended over a short period of time with an emphasis on immediate impact.

- Endowed Funds, which last in perpetuity and have a long-term impact. Donors may contribute to the Foundation endowment with a gift of any amount or establish a named endowment fund with gifts starting at $25,000.

Cash

A cash gift is the simplest way to establish a named fund or add to an existing fund. Cash gifts are fully deductible up to 60% of the donor’s adjusted gross income in any one year. Deductions exceeding this limit may be carried forward for up to five additional years.

Securities

Gifts of appreciated securities (bonds and stock, including stock in closely held companies) may also be used to establish a fund or add to an existing fund. Such gifts often provide important tax advantages. The benefit of giving appreciated securities is the avoidance of capital gains tax on the appreciated portion of the gift. Gifts of closely-held stock enjoy the same tax benefits as with publicly traded stock. As with gifts of cash, deduction amounts exceeding this limit may be carried forward for up to five years.

Bequests

You can establish or add to a fund through a bequest in your will or trust. Your gift can be used to accomplish almost any charitable goal:

- Supporting current and future community needs

- Establishing a scholarship fund

- Creating an endowment for a particular charity

- Leaving a family legacy, which allows children to be involved in charitable grantmaking

Memorial or Honorary Gifts

You can create a new fund as a tribute or give to an existing fund. Memorial gifts are designed to honor a living person, memorialize a deceased person, or commemorate anniversaries or other special events. Unless otherwise specified, memorial contributions are added to the Foundation’s Community Grants Fund or Operating Endowment.

Pension Plans or IRA’s

A retirement plan is one of the best assets to transfer to a charity because it represents taxable income. Most inherited assets are free from income tax. However, an heir will pay income tax on disbursements from a decedent’s retirement plan such as a profit-sharing plan, Section 401(k) plan or IRA. If you are going to make a charitable bequest, it is usually better to transfer the taxable assets to a tax-exempt charity and leave the assets not subject to income tax to heirs.

Life Income Plans

As a community foundation, we can administer charitable remainder unitrusts and annuity trusts, both of which pay lifetime income to you or other named beneficiaries.

Establishing a trust can be done by transferring cash or property to the trust. The income beneficiaries receive annually an amount equal to a fixed percentage of the trust’s fair market value (unitrust) or a fixed dollar amount (annuity trust). Upon termination of the trust, the assets are transferred to your named charitable fund to support your individual or personal charitable giving goals.

Charitable Gift Annuities

A charitable gift annuity from our community foundation allows you to receive a guaranteed income for life and an immediate income tax deduction, while at the same time leaving a legacy to the charitable cause of your choice.

Through a charitable gift annuity, you receive a fixed stream of income for life. After paying the lifetime annuity to you and your spouse, the remaining principal is transferred to your named charitable fund to accomplish your specific goals. Payments to you are based on your age; the older you are, the higher the rate. If the annuity is for both you and your spouse, the calculation is based on your joint ages. If you don’t need the income now, you can use our deferred plan and receive the income tax deduction now but begin receiving payments when you reach a specific age. This is an excellent complement to your existing retirement plan.

Life Insurance

Life insurance policies can also be used as charitable gifts. If you name our foundation as the owner and beneficiary of an existing or new life insurance policy, you receive an immediate tax deduction, which usually approximates the cash surrender value of the policy. All premium payments made by you thereafter will be deductible as a charitable contribution.

Life Insurance Beneficiaries

Perhaps you would like to contribute the proceeds of a life insurance policy to help the community, but you are not yet ready to give up ownership of the policy. By naming a community foundation as beneficiary, you retain ownership of the policy and have access to the cash value as well as the right to change the beneficiary.

If you do not have liquid assets right now but want to support a favorite charity, a gift of life insurance may be a good option. While you retain ownership of the policy, there is no charitable deduction for the value of the policy when you designate a community foundation as the beneficiary or for subsequent insurance premiums. However, proceeds payable to the community foundation at your death will not be subject to federal estate taxes.

The tax advantages of both a current and deferred annuity are two-fold. First, you receive an immediate tax deduction when you create your annuity. This is based on your age and annuity payout rate. Second, a portion of the payments you receive may be treated either as tax-free return of principal or long-term capital gain. These tax advantages increase the net income you receive.

*The Delaware County Foundation does not provide legal or financial advice. Donors are encouraged to contact their legal and financial advisors especially when making a planned gift through the Foundation or any other charity.

Types of Funds

Unrestricted Fund

Unrestricted Funds are not designated for a particular nonprofit, cause or area of interest. Our Board of Directors oversees the use of these funds, setting priorities and determining how grants will be distributed. Unrestricted Funds give us the flexibility to respond to the most pressing needs in the community.

Donor Advised

Donor Advised Funds are established by those who wish to actively participate in the grant-making process. This type of fund makes it easy to give to multiple nonprofits. Grants from the fund can be made on a regular basis or when the need arises. Our Board of Directors is legally responsible for approving all grants.

Field of Interest Fund

Field of Interest Funds support a particular area of interest or program, cause or geographic area. At the donor’s request, use of the fund is restricted but flexibility remains to meet changing situations. For example, a Field of Interest Fund could support the arts, early childhood education or out-of-poverty programs.

Designated Fund

Donors who wish to support one or more specific nonprofits can establish a Designated Fund. You can create a new Designated Fund or contribute to an existing one. If the original charity ceases to exist or is unable to perform its charitable purposes, our Board of Directors can direct the funds to a similar cause or organization without the cost of expensive legal action.

Scholarship Fund

A Scholarship Fund can benefit students at any education level or support those attending a specific high school or university. It can be established to honor a loved one. Some donors choose to stay involved through advisory relationships, while others ask the Foundation to select recipients.

Endowments

When you make an endowed gift you create a permanent legacy of support for the organizations and causes you care most about.

Created in your lifetime or bequeathed in your will, endowments provide support to fund a specific purpose in perpetuity.

How does it work?

An endowment is a long-term fund invested to provide predictable and steady support for the donor’s intended purpose.

Endowments are intended to be held in perpetuity and are subject to a spending policy that limits annual distributions from the fund. This preserves the fund in perpetuity, guaranteeing donors will have an impact on the community for generations to come.

What is the capital minimum to establish an endowment?

Endowment funds can be established with gifts of $25,000 or more.